A global recession can be avoided, but risks are high

World real GDP likely declined in the second quarter of 2022, but this expected outcome is not inevitably the beginning of a global recession.

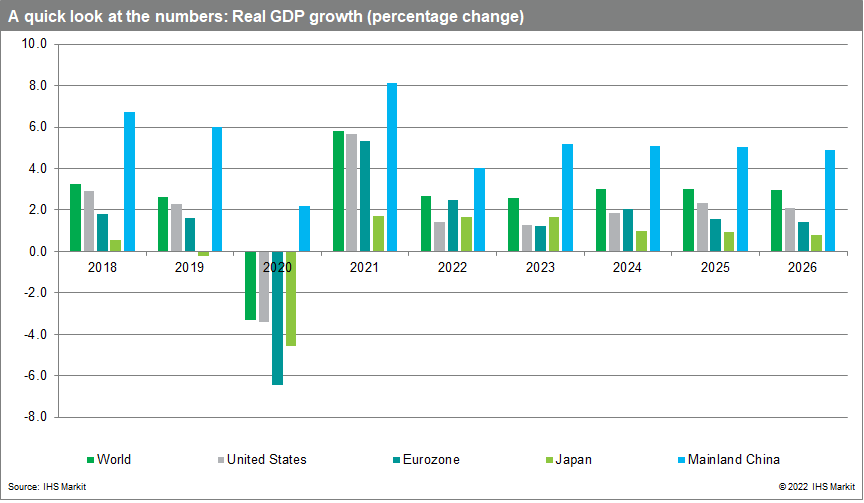

Entering 2022, the global economy was headed for a major slowdown. As inflation raged, central banks accelerated the pace of monetary policy tightening, aiming to slow the growth of aggregate demand and calm price pressures. Two shocks intervened—Russia's invasion of Ukraine on 24 February and lockdowns in mainland China in response to a March-April surge in COVID-19 cases. These shocks further disrupted supply chains, adding to cost pressures. At the same time, soaring energy and food prices eroded consumer purchasing power and sentiment. After growing at annual rates of 6.0% quarter on quarter (q/q) in the fourth quarter of 2021 and 3.5% in the first quarter of 2022, world real GDP fell an estimated 1.7% in the second quarter. Among the major economies in decline were the United States, eurozone, United Kingdom, mainland China, Taiwan, Russia, Poland, Turkey, and South Africa.

What's ahead? A period of subpar global growth is the most likely outcome.

Absent new shocks, the global economy is projected to resume growth, albeit at a tepid annual pace of under 2.0% q/q in the third and fourth quarters of 2022. Mainland China is reopening after lockdowns and Asia Pacific's emerging markets are achieving solid growth even as European and US economies struggle. Worldwide, the transition from pandemic to endemic for COVID-19 is enabling growth in travel, tourism, and other consumer service sectors that were hit hard during the 2020 recession. In advanced countries, household finances are generally in good shape, thanks to accumulated savings and asset appreciation in 2020-21. In a cycle dominated by consumer spending, households are positioned to drive the global expansion forward.

After a 3.3% contraction in 2020 and a 5.8% rebound in 2021, global real GDP growth is projected to slow to 2.7% in 2022 and 2.6% in 2023.

This forecast is marked down by 0.2 percentage point in 2022 and 0.3 percentage point in 2023. The 2022 downgrade is attributable to the US economy's weaker first-half performance, while the 2023 downgrade reflects the widespread impacts of more restrictive financial conditions. With the world's population growing about 1.0% annually, our outlook implies solid gains in real per capita GDP and thus avoidance of a global recession.

Rapidly tightening financial conditions pose a downside risk to global growth.

In response to persistently high inflation and an upward drift in long-run inflation expectations, central banks are accelerating monetary policy tightening. While the 10-year US Treasury yield has retreated from mid-June highs to around 3.0%, risk spreads have widened, raising financing costs for businesses and households. More emerging markets appear unable to raise new international bonds at sustainable cost levels, forcing them to seek alternative funding sources. Investors' flight to safety would likely mean continued strength in the US dollar and elevated risks for emerging markets that depend on capital inflows to finance trade and fiscal deficits.

Housing markets are especially vulnerable in the current environment.

Low mortgage rates and increased mobility with the work-from-home trend have fueled housing bubbles around the world. Rising mortgage rates and inflated home prices have hurt affordability, which reduced demand. The resulting market corrections will have adverse consequences for household net worth, residential construction, and consumer durables spending. Nonresidential building construction is also sensitive to interest rates and could see further declines in areas with high vacancies.

With commodity prices falling, downstream inflation is nearing an inflection point.

In response to rising interest rates, US dollar appreciation, and recession fears, a broad retreat in industrial and agricultural commodity prices is under way. The IHS Markit Materials Price Index (MPI) fell 8.4% in the four weeks ended 15 July, led by declines in prices of metals, chemicals, fibers, and rubber. The retreat in commodity prices is filtering downstream, causing inflation in prices of intermediate goods to slow globally. Evidence of decelerating prices of finished goods will become more pervasive in the final quarter of 2022. Global consumer price inflation is projected to ease from 7.3% in 2022 to 4.2% in 2023 and 2.7% in 2024.

The US economy has stalled, but it is not in recession—yet.

US real GDP declined at an annual rate of 1.6% q/q in the first quarter, pulled down by a sharp rise in imports and a decline in exports. We expect a similar contraction in the second quarter, owing to a sharp reduction in inventory accumulation. This episode is unlikely to meet the broad criteria for a recession set by the National Bureau of Economic Research, as it difficult to square the real GDP losses with notable gains in employment, incomes, and personal consumption. Yet, the path forward will be difficult. The Federal Reserve has signaled a willingness to raise interest rates enough to slow inflation to its 2% target, even if the result is a recession. The boom in housing markets is reversing, and businesses will likely rein in capital spending and hiring plans. Real GDP growth is projected to slow from 5.7% in 2021 to just 1.4% in 2022 and 1.3% in 2023 before picking up to 1.9% in 2024. With real GDP growth running below potential, the unemployment rate will rise from 3.6% in June to a high of near 5.0% in 2024.

High energy costs are pushing Western Europe toward recession.

Our July forecast already incorporates mild second-quarter contractions in real GDP in the UK, Italy, Spain, and the Netherlands. With inflation surprising on the upside, the central banks are stepping up the pace of monetary policy tightening. While a rebound in tourism and consumer services might give the region a slight lift in the summer quarter, another setback is likely in the fourth quarter given unreliable energy supplies. Exceptionally high natural gas and electricity prices will damage industrial competitiveness in Germany and other manufacturing centers. The destructive Russia-Ukraine war will likely drag on through 2022, deflating consumer and business confidence across Europe. Eurozone real GDP growth is projected to slow from 5.4% in 2021 to 2.5% in 2022 and 1.2% in 2023 before improving to 2.0% in 2024.

Mainland China's economy is tentatively recovering from COVID-19 lockdowns.

Mainland China's real GDP declined 2.6% q/q in the second quarter, resulting in 0.4% year on year (y/y) in growth that was supported by infrastructure spending and investment by state-owned firms. Monthly data suggest a broadening recovery in June. The government's dynamic zero-COVID policy will remain in place through at least March 2023, preventing a return to normalcy and limiting the effectiveness of economic stimulus. The property market remains in recession, and declining land sales are hurting local government finances. Real GDP growth is projected to slow from 8.1% in 2021 to 4.0% in 2022 before strengthening to 5.2% in 2023.

Asia Pacific will dominate global growth as other regions falter.

Resilient growth in Asia Pacific is key to our outlook of sustained global economic growth in 2022 and 2023. This region will likely account for 53% of global real GDP growth in 2022 and an exceptional 62% in 2023 (its contribution is projected to average about 56% over the next decade). After slowing from 6.2% in 2021 to 3.9% in 2022, Asia Pacific's real GDP growth is projected to settle at 4.4% in both 2023 and 2024. India, Indonesia, Vietnam, and the Philippines will likely achieve growth rates of 5-7%. This performance reflects strong intraregional growth dynamics related to regional free-trade agreements, efficient supply chains, competitive costs, and steady inflows of foreign direct investment. The region is also benefiting from strong pent-up demand for semiconductors and autos. Parts of the region experienced later waves of COVID-19 and are now experiencing robust recoveries following the easing of pandemic restrictions.

Bottom line

While the global economy is expected to avert a recession, business conditions will be increasingly difficult in the year ahead as financial markets tighten. The risk of recession remains high—in the 40-50% range in major economies. Our next forecast will likely include downward revisions in interest rate-sensitive sectors such as housing, consumer durables, and business capital spending.

Posted 25 July 2022 by Sara Johnson, Executive Director – Economic Research, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

25 July 2022, Sara Johnson

Source : https://ihsmarkit.com/research-analysis/a-global-recession-can-be-avoided-but-risks-are-high.html