Your Capital. Your Control. Our Automated Intelligence

The region’s premier Sharia-compliant Forex automation (Currencies only). Backed by 6 years of proven algorithmic performance, FundyFund offers a smart, non-custodial solution that integrates directly with your personal brokerage account—generating consistent monthly returns while you maintain absolute ownership of your funds.

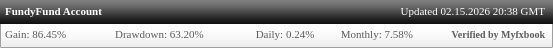

Real Results

in Real-Time

We don’t just talk about results; we demonstrate them. View live, transparent data directly from one of our primary trading accounts.

Start Your Journey to Automated Wealth

Automated Forex Trading | Capital Stability

Non-Custodial Investment

1. Securely Launch Your Investment

Open a personal account with your broker of choice (must be a Swap-Free/Islamic account).

Deposit your investment directly into your account (Min. $5,000).

Your funds stay under your name, and you are the only one with withdrawal authority.

2. Seamless Technical Integration

Connect with us to choose the plan that fits your goals.

We link our smart technology via a secure, 'Trade-Only' API.

Our system purely executes trades and can never access, move, or withdraw your funds.

3. Monitor Results and Growth

Track your balance and performance in real-time via your broker's mobile app.

Trading cycles typically run 30–50 days, after which you have full freedom to withdraw profits or reinvest for compounded growth.

We only win when you win.

Clients Satisfaction Rate

Clients Retention Rate

Algorithm Research & Testing

Institutional Trading Expertise

Dynamic Market Intelligence

Risk-Reward Optimization: An optimal blend of risk management and significant return potential.

Algorithmic Agility: Real-time strategy adaptation to maximize institutional-grade execution.

Automated Forex Trading: High-frequency algorithms designed for diverse market conditions.

Full Transparency

Real-Time Tracking: Monitor your account 24/7 via your broker’s mobile app.

Post-Profit Fees: No upfront costs; we only earn after you profit.

Cycle Flexibility: Withdraw, deposit, or scale at the end of every cycle.

Capital Preservation Tier

Conservative Growth: Engineered for steady, reliable performance with a focus on stability.

Priority Safety: Strategy logic is optimized to minimize volatility during market shifts.

Islamic Infrastructure: Fully Sharia-compliant (Swap-free) account setup.

100% Personal Custody

Non-Custodial Model: Your capital remains in your personal broker account at all times.

Zero-Withdrawal API: Our technology is mathematically restricted to execution-only operations.

Exclusive Control: You are the sole custodian with exclusive access to your withdrawal keys.

Build Your Legacy, Not Your Stress

Stop chasing market fluctuations. FundyFund’s smart automated trading technology works silently to ensure your wealth grows while you focus on enjoying your life. Most importantly, your funds remain in your personal account and under your absolute control at all times, providing you with unmatched security and total peace of mind.

- Time Freedom

- 100% Fund Custody

- Post-Profit Fees

- 24/7 Account Control

Choose Your Optimal Path to Wealth Growth

Accelerated

FundyFund doubles your trading capital by crediting funds to your account.

- Profit Distribution:

- 40% Your Share

- 30% FundyFund's Share

- 25% Operational Fees

- 5% for "Waqf" Fund *

- Safety Ceiling: 30-45% Max Drawdown

- Trading Cycle: 30-50 Days

- Minimum Deposit: $5,000

- 100% Client Custody (Non-Custodial)

- Secure "Trade-Only" API Connection

- LiteFinance / Highness Brokers Only

- 24/7 Real-Time Monitoring

Balanced

Optimal blend of dynamic risk management and significant return potential.

- Profit Distribution:

- 40% Your Share

- 30% FundyFund's Share

- 25% Operational Fees

- 5% for "Waqf" Fund *

- Choose Safety Ceiling: 30-70% Max Drawdown

- Trading Cycle: 30-50 Days

- Minimum Deposit: $5,000

- 100% Client Custody (Non-Custodial)

- Secure "Trade-Only" API Connection

- Available on All Supported Brokers

- 24/7 Real-Time Monitoring

Safe Core

Designed for capital preservation and steady, reliable conservative growth

- Profit Distribution:

- 40% Your Share

- 30% FundyFund's Share

- 25% Operational Fees

- 5% for "Waqf" Fund *

- Choose Safety Ceiling: 30-50% Max Drawdown

- Trading Cycle: 30-50 Days

- Minimum Deposit: $10,000

- 100% Client Custody (Non-Custodial)

- Secure "Trade-Only" API Connection

- Available on All Supported Brokers

- 24/7 Real-Time Monitoring

Remove Emotion, Restore Profit

Manual trading is often a battle against your own nerves. Our smart automated system follows cold, hard logic—executing trades based on data-driven strategies that don't get tired, stressed, or greedy, ensuring your capital is managed with discipline 24/7.

Frequently Asked Questions

No, we do not receive or hold any funds from our clients. Your trading capital always remains in your personal brokerage account. We provide the technology and software only, while you remain the sole owner and controller of your funds. Our company never asks you to deposit trading capital into its accounts.

Absolutely not. FundyFund, including all its systems, has no access to your funds and cannot perform any withdrawals or deposits. We operate strictly as a technology and software solution provider. Your funds remain entirely within your personal account with your chosen Broker, with whom you deal directly. You are the sole individual with absolute control over your capital movements. Our role is exclusively limited to connecting algorithms and executing trades automatically based on your pre-defined risk settings through technical connection credentials, which do not grant any financial authority to any third party.

Our technology is designed to work seamlessly with the majority of global brokerage firms that support MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms. However, to ensure the algorithms perform at maximum efficiency and that results align with our software strategy, we recommend choosing a broker that meets the following technical specifications:

* Leverage: It is recommended to select a leverage of at least 1:400. This ensures sufficient Margin is available to execute multiple trades and prevents the system from being halted by a margin call.

* Account Type: The broker must support Swap-Free (Islamic) accounts to ensure trades remain free of overnight interest charges.

* Capital Suitability: For accounts with capital less than $30,000 USD, you must open a Cent Account to ensure precise risk management and professional lot size distribution.

* Execution & Spreads: We prefer brokers that provide ECN execution and Low Spreads to ensure trades are processed in real-time with minimal slippage.

At FundyFund, we do not mandate a specific broker. We provide the client with full freedom of choice and absolute control over their account, emphasizing that the chosen broker must meet the technical requirements mentioned above to ensure performance stability.

Since trades are executed on the broker's infrastructure, fundy.fund is not responsible for broker-side issues such as server downtime, slippage, or platform crashes. We provide the "brain" (the signal), but your broker provides the "engine" (the execution).

Our smart system acts as a "Master Account". When our algorithm identifies a logical trade, it sends a signal to your "Slave Account" at your broker, which then mirrors the trade automatically in real-time.

Absolutely. Because you own the broker account, you can disconnect the automation, close trades manually, or change your password at any time to instantly stop all activity. You are always the final authority on your account.

Our algorithms are programmed to keep Drawdown (temporary peak-to-valley loss) within a the specified raHistorically, the strategy recorded a maximum drawdown (Max Drawdown) of up to 68% for the Balanced option, a condition that lasted for a brief period (less than 24 hours) before the market rebounded and the system recovered. It is essential to understand that this data is purely statistical and based on past performance, not a guarantee of future results.

Accordingly, FundyFund grants clients full authority to set a "Stop Loss" as a safety valve to protect their capital at a specific drawdown percentage of their choice. However, clients should be aware that triggering this option means trades will be closed immediately, which may result in missing potential "market rebound" opportunities to recover losses and return to profitability.nge based on selected package. The system uses strict automated stop-losses to ensure your account balance is never exposed to "catastrophic" manual errors.

We believe in Performance-First Billing. You do not pay us any upfront fees. At the end of a 30-50 day cycle, once the profit is sitting in your account, you simply transfer our agreed share to continue the service.

To protect your account's margin and risk settings, all capital moves are handled at the end of each 30-50 day cycle. Once the cycle concludes and the performance fee is settled, you can freely withdraw profits or deposit more capital to scale for the next period.

There are no time restrictions. You are the sole owner of the account, and you can terminate the technical connection and stop the service at any moment without any penalties. We believe the quality of our results is what retains our clients, not binding contracts.

We prioritize the currency market because it is the most liquid and stable financial market in the world. This high liquidity allows our automated algorithms to execute high-frequency trades with minimal "slippage," ensuring that your entries and exits are precise and your capital is protected from the extreme volatility seen in crypto or individual stocks.

.png)

.png)